No products in the cart.

Cart / $0.00

No products in the cart.

How to add GST billing in WooCommerce plugin 2025

This Article will guide you about adding GST billing in WooCommerce. As you know GST mean GOODS & SERVICE TAX came into force on 1st july 2017. It promoted as ONE NATION ONE TAX in India. So its important for all sellers (Online or offline) and shopkeepers to generate GST invoice for all purchase. One of our reader asked us “How to add the GST taxes system in WooCommerce” since he is using WordPress to sell his product online.

In WooCommerce adding GST tax is just like adding normal tax slabs but only difference is TAX RATES. For every Tax rate, we have to create a tax class. In simple words, different products have different slabs for GST, like some has 18% GST slab while other has 12%. It totally depends what you selling or providing services.

Table of Contents

If you have Multivendor Store and Using WCFM Multivendor Plugin then click here to learn “How to setup up GST billing in Multivendor Store”.

So lets make it quick for you to how to add GST Tax Slab in Woocommerce. Follow step by step guide to add GST billing in WooCommerce :

Login into your wordpress dashboard to change GST billing in WooCommerce.

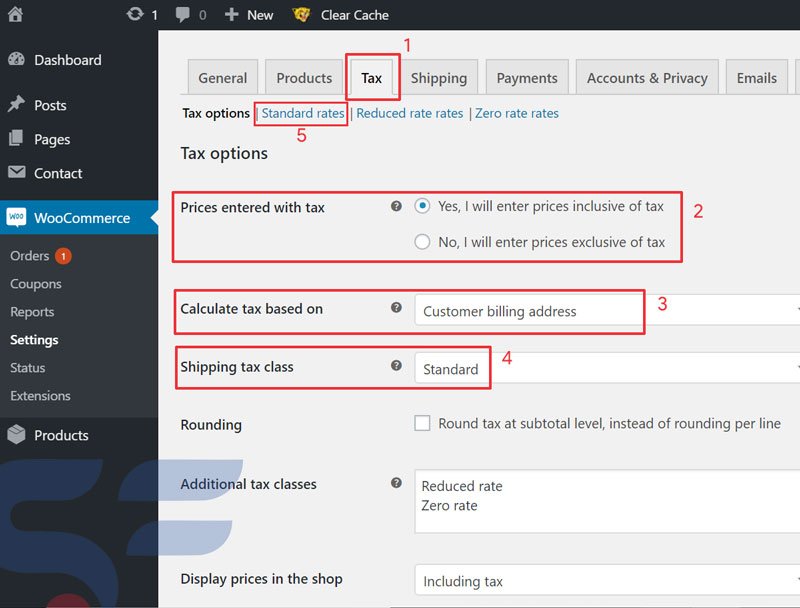

- Click on woocommerce option then go to settings and click on TAX tab at top.

- Under TAX tab, put a check mark on Enable Tax and Tax calculations.

- Select any option from “Price entered with Tax” option as per your choice.

- Select option from “Calculate Tax based on” as per your choice.

- Select Shipping Tax class as Standard

- Other Option below this you can select as per your requirement.

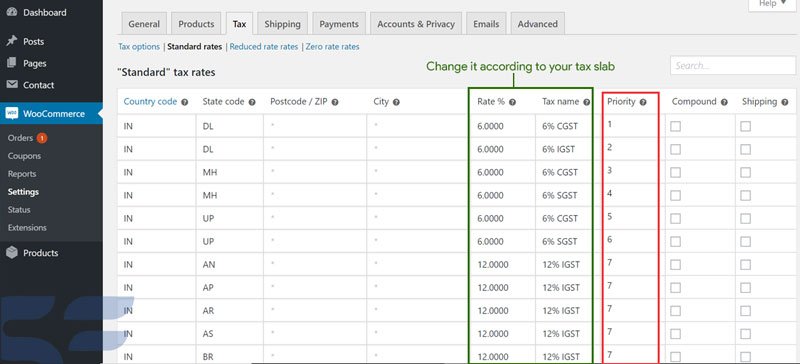

- Now on same page , click on standard rates at top

- In standard tax option click on Import CSV button to import the Tax rates based on different states. Download the CSV from here.

- After downloading the CSV file, import it from the option.

Please note :

Our CSV contains all the state codes and the rates considering Uttar Pradesh as the shop location for Ayurvedic products which comes under 12% GST slab. It contains both CGST+SGST and IGST columns as per state. Please note this point during adding GST billing in WooCommerce Plugin

Like If your shop is in Uttar Pradesh then bills generate for customers in Uttar Pradesh includes (CGST + SGST) and for customers outside Uttar Pradesh will have IGST as TAX.

To define this concept we set the priority numbers for all states. (Do not change it) so that tax can be applied correctly. Also make sure all compound and shipping column is unchecked. In image below we defined different numbers as priority for different states and union territory (All UT has SGST+CGST). Also please modify it according to your tax slab like 18% or 28% etc.

So that all you need to do for displaying GST tax at your online shop. When any customer will do checkout on website, GST tax will be automatically displayed as per your settings like inclusive or exclusive and GST will be calculated as per billing address or shipping address (One you selected in settings). To know more about the GST tax slabs, contact your CA or you can visit https://www.gst.gov.in/ . Hope you find the easiest way to add the GST in your online shop.

If you wanna add multiple GST tax slabs/percentage in WooCommerce products then click here. For any other queries or suggestion please comment below. Let us know if you need any Developer help.

How to aad the different tax slabs according to product? Please help

Dear Sir,

I have one problem GST Settings WordPress. SGST, CGST and IGST please contact me.

Thanks & Regards

(Shivshankar N. Nageshwar)

Mob No. :- 9960801063.

CSV file is missing.

Hi, sorry for that , files is now available for download.

Hello, For MH it specifies CGST and SGST, not IGST even though MH is not UP. Do i need to alter it?

Yes, Gaurav you can alter it according to your requirement.

Dear Sir,

I have one problem GST Settings WordPress. Maharashtra SGST, CGST and Other State IGST please contact me.

Thanks & Regards

(Shivshankar N. Nageshwar)

Mob No. :- 9960801063.

What needs to be altered? Since you have mentioned not to alter the priority numbers for all states. Even I want to implement for MH for SGST and CGST and rest of the states IGST. Kindly help. Thanks.

Hi Kshitij,

You can edit the excel file priority. Download the excel file, replace the UP with MH and MH with UP.

that’s all done.

Thanks so much 🙂

Can I use this for multivendor sites? Will it configure tax for multivendor platform?

Hi,

yes you can use this in multi vendor site. Yes it will be configured.

Regards

Hi, Could you please guide how to configure for multivendor website.? Share a csv file if possibe.

Thanks & Reagrds

hi Sasi

For multivendor platform, you have to use customized solutions for plugin(woocommerce or any other multivendor plugin). Let us know if you want any customized solutions.

Regards

Hi it can be implemented for Multivendor Woocommerce Website having multi seller with different shop location. How it works when Woocommerce General setting have Shop location based in the state of Delhi and Website has sellers from different location. In such a case how GST tax will be confirgured according to Sellers shop location keeping aside the shop location of Website. Please help.

If you have any Excel File please share.

Thank You.

hi,

I have a grocery store and having too much inventory in multiple items & calculation of GST on those item are very difficult. because we have 5 different GST tax slabs from 0%,5%,12%,18%,28%,40% and each GST slab has so many multiple products .

kindly help to how I can fix the issue.

Prob is – If any client buys multiple items on the single bill so, How GST calculate on item wise?

please revert me asap…

Hi,

You have to create multiple tax slabs and categorize the products according to Tax slab. For a customer having multiple tax slab items tx will be collected according to product value not on cart value.

Regards

Hi I’m new at this business

I wanted to ask whether tax will be collected by the payment gateway or we have to submit it or file it through a CA?

Hi,

You can select the tax amount according to your business like inclusive or exclusive. After sales you have to give all sales bills/invoices to your CA to file GST. Payment gateway also charges GST for collecting payments from your customer, for which you can collect their GST invoice from payment gateway dashboard and send it to your CA. CA will file the GST tax for you. For more info whatsapp us at : 7838741037

Regards

Hello,

Very Nice explanation for adding GST tax slabs. Showing Tax slabs in order section in dashboard.

Though I am facing an issue…my cart still shows inc. VAT.

Also please guide me on how to send attached invoices in GST form which can be printed at both customer and storeowner end.

Thanks & Regards

hi Tarun,

You can use lots of plugin which can automatically generate the GST invoice for your customer and send it via email.

To show inc. GST you have to define the standard TAX and give it a proper name.

Let us know if you need specific help.

Regards

How to mention GST percentage & charges in the invoice that we have to send with the product. If the product price is inclusive of GST.?

Hi vishal

You can use any third party invoice builder plugin or even you can use woo-commerce inbuilt invoice feature to show tax breakup. You just need to define the tax type and amount entry as inclusive or exclusive in woo-commerce settings. It will automatically pick the settings.

Regards

how to set GST for multivendor platform. the GST has to be as per the seller location.

hi Prasenjit

For multivendor platform, you have to use customized solutions for plugin(woocommerce or any other multivendor plugin). Let us know if you want any customized solutions.

Regards

Hi as I have created slabs for gst tax.I want to display product price with both taxes added.It is showing while I’m logged in as it takes my address from my registration details.But while I log out my store shows price exclusive of taxes as it doesn’t know about my state and country.I want to display product price with tax added without user login.

Hi Abhisake,

To implement that you can use Geolocation based taxation plugin.

Regards

Hi

I’m uploading csv file for all products like I’ve 4 different tax category but it only reflects in the Standard rates section and secondly the prices of the products get changed

Hi Radha,

You can defined different tax slabs from woo commerce settings. and select respective tax in products tax settings. Prices display depends how you show it either itemized and as whole in woocommerce settings.

Regards

hi

i have one problem how to change text VAT to GST in checkout process of wordpress

Hello Pavethran,

You can do it by changing the name in tax setting of woocommerce.

Regards

Hello sir,

I am using WCFM , but facing challenges to configure GST rates identification for inter or intra supply for different stores in different states.

For Example :-

Case :- 1

I have one vendor V1 in madhya pradesh supply services (GST 18) in Madhya pradhesh only, here supply is intra. CGST and sGST shall be charged. working fine currently.

Case :- 2

I have same vendor V1 in madhya pradesh supply services (GST 18) in maharashta only, here supply is inter. igst shall be charged. working fine currently.

Case 1 and Case 2 is working fine when i have considered base location of state as madhya pradesh in TAX setting for GST state.

But, consider CASE 3 :-

I have another vendor V2 in Delhi supply services (GST 18) in Delhi only, here supply is intra. CSGT AND SGST is applicable. Now since i have used settings for madhya pradesh as a base location, IGST is getting charged which is incorrect.

Can you share me excel sheet

Hello heena

You have to set the tax location as customer or none

Regards

I uploaded the available csv file for tax but its not working for states . I arranged HR state code with 6% CGST and 6% SGST while and priority 1 and 2, while other states comes under 12 % IGST and having priority of 3.

While in calculation it always shows 6% CGST and 6% SGST for any state selected for billing.

Kindly suggest the solutions..

Regards

Vikas Mishra

9811442146

hi vikas,

Please check settings of your tax if its on customer’s billing or shop base location. GST always implement on customer billing address. if still facing issue just ping us on whatsapp at 7838741037

Regards

hello

https://scriptfeeds.com/blog/development/gst-billing-in-woocommerce/

in this script, i have two question – suppose if i have both 5% and 12% products in a single invoice, which tax rate will shipping column take ???

Q2 What does compound tax rate mean in your excel template

You don’t really need that long list to maintain. The list should have only 3 rows. Let me explain.

Suppose, your shop is in UP and GST rate is 12%. Then, first add a row with followings:

Add a second row:

Add a third row:

That’s it. That’ll do the job.

NOTE: If you use tax rate 18%, then ‘Shipping’ option should be Checked. The reason is shipping cost GST rate is 18% in India (as of now).